AUGUST-SEPTEMBER 2020 COMMENTARY

Global equities throughout the world are continuing to recover from their pandemic-induced nadir reached in late March. August was another strong month particularly in the US with the large cap, technology-laden, NASDAQ Composite rallying 9.7% and the broader S&P 500 tacking on 7.2% as both indices continue to post higher highs, a technical bullish sign. As the American Summer comes to a close these indices have marked five consecutive monthly gains advancing 72.3% and 57.7% respectively, since their low on March 23rd. The speed and magnitude of the recovery is breathtaking, making some market observers refer to it as a “V” or even a “Super V” recovery. This makes for great imagery, but we prefer not get caught up in hyperbole and more importantly not succumb to the emotion of the moment.

We believe that the rally in risk assets has been largely supported by the incredible force of monetary and fiscal stimulus, predominantly in the US, but also abroad. Yet there is perhaps an equally powerful structural phenomena driving US mega cap technology stocks, taking the form of demand from remote work, commerce and learning. Corporations and institutions are reassessing the need for in person face-to-face interaction, real estate footprints, and travel among other considerations. This development has positive and negative consequences for the economy at large, but we view it primarily as a reapportionment of economic opportunity which will leave individual winners and losers with changes in work, consumption, and mobility patterns.

For the past several weeks, we have been discussing the challenged state of the US labor force juxtaposed against the favorable consumer trends in terms of high savings rates, low personal balance sheet leverage and expanding personal consumption. At a high level, the labor market is improving, yet unlikely to fully recover until well into 2021, and the consumer is in reasonably good shape while average hourly earnings are climbing. The bad news in those numbers is the advance in average hourly earnings is being driven by the lower end of the wage scale dropping out of the work force while higher earners remain employed and can “Zoom it in” to engage with their co-workers.

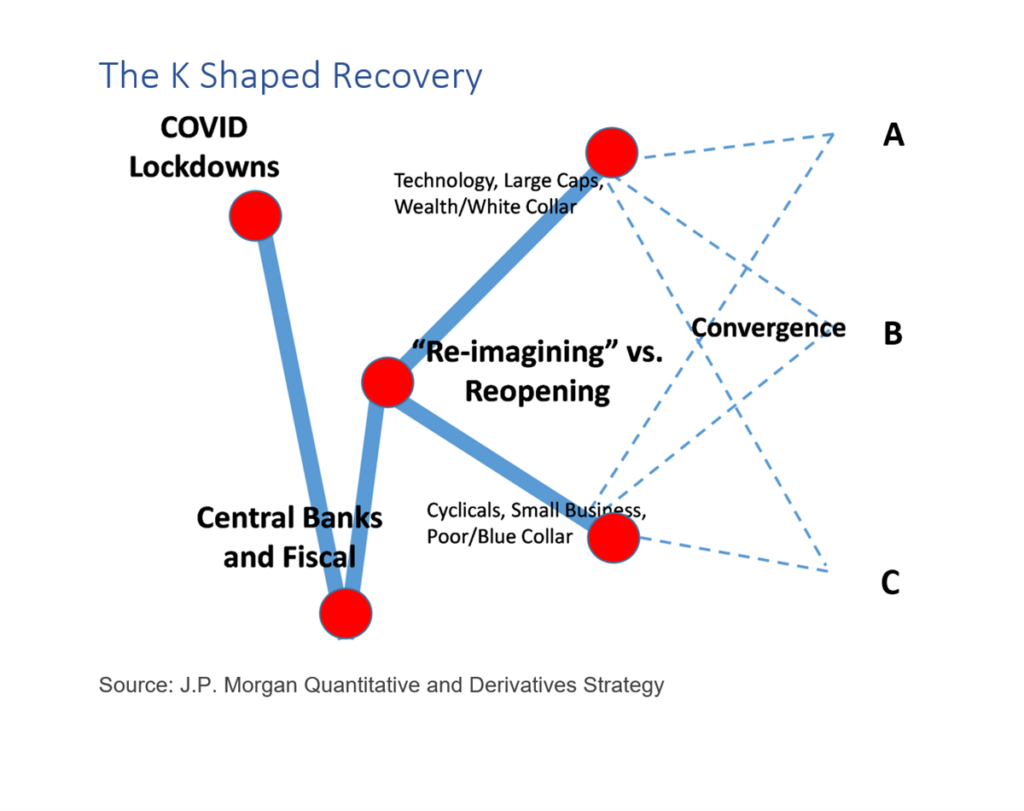

Recently, the “K” shaped recovery has been the focus of analysts and economists and this is one of the more instructive graphics we have seen in some time. This image is courtesy of JP Morgan’s quantitative group, but the concept has been widely circulated and discussed throughout the investment community.

It depicts the capital market and economic divergence that is occurring among those higher wage earners and companies with access to technology, contrasted with certain service sector employees and smaller businesses. The solid lines mark the path that the two broad segments of the capital markets and economy have traveled while the dotted lines offer guidance for possible future outcomes.

The dotted lines also meet in the area marked “Convergence” on the graphic with the upper most point A showing the technology-sensitive sector continuing to advance along with an accelerated “catch-up” in the cyclical/small business segment. Point B would mark a deceleration in the former and a less robust recovery in the latter. Point C would imply a decline in both segments of the capital markets and economy.

We believe the most likely path in the US, with several larger bumps and persistent volatility, will resemble path “A” because the Federal Reserve and the Federal government are committed to supporting employment, and corporations will likely continue to invest in technology to enable remote employment and commerce.

PORTFOLIO POSITIONING

In terms of overall positioning, we are overweight equities due, in part, to equity market trends and we are underweight fixed income. We are also underweight cash. Within global equities, we are overweight the U.S., Asia x-Japan and Emerging Markets. We are neutral with respect to Eurozone stocks and underweight Japan. Within fixed income, we are overweight in the U.S. with a preference for mortgages and investment grade corporate credit. We have little to no exposure to non-U.S. fixed income. Our portfolios maintain lower duration than the benchmark. Our cash position is lower than our benchmark.

RISK OUTLOOK

- National election campaign season is underway in the US as public health challenges and social unrest continue across the country. The country is wrestling with a history of socioeconomic, racial, and gender-based discrimination that has erupted into the town square as the pandemic further aggravated persistent inequities. The trauma is being socialized as rioting, looting and arson have devastated some businesses and communities trying to emerge from the pandemic lock-down. The election results could escalate emotions and hostilities causing further economic damage. We are also mindful of the consequences of persistent uncertainty if results are not definitive soon after polls close given the time-intensive nature of counting mail-in ballots.

- Economies around the globe are on the path to re-opening but it remains to be seen how long the fallout will linger. Probably the most critical risk is the sustainability of the US economic and labor market recovery. Will the stimulus be enough? We are seeing positive recovery trends in the US labor market, but the world is a long way from full employment. Our concern is will we be pushing on a string later in the year and into 2021?

- The potential for an acceleration of virus cases coincident with the traditional Fall return-to-work and return-to-school season along with cooler weather that brings people back indoors is of great concern. Some US states are experiencing their first wave of infections and others which got an early handle on transmission are seeing resurgences, but with some bright(er) spots like New York, New Jersey and Connecticut that are in markedly better shape than mid-Spring. The ebb and flow of the virus’ toll on the human condition will likely weight on markets.

- Chinese Communist Party actions pose near and long-term risk. From aggression in the Asia-Pacific region to military tension along the border with India to suppression of Hong Kong citizens’ rights and the lack of contrition for their early role in failing to stop COVID-19 in its tracks, all may contribute to China-directed backlash or retaliation. There does seem to be regional coherency in the response as nearly all Pacific nations have aligned with the US against Chinese aggression. We continue to find it odd that the CCP has chosen hostility when they arguably need the rest of the world for their own recovery efforts in their weakened economic condition. From lack of respect for intellectual property rights to involvement in global criminal drug trafficking to financial crimes and human rights abuses bordering on genocide, the country is finding it harder to get the global community to look the other way.

- Accelerating and likely permanent changes to consumer behavior and global supply chains that in many cases were already under way and have been amped up by CoV-2 are likely to create further near- and long-term disruption but also opportunity as more local, sustainable and safe sources of goods and services emerge.

ESG CONSIDERATIONS

When thinking about environmental, social and governance factors (ESG) in investment decisionmaking, emphasis often lands on macro topics like climate change, food security or transparent reporting and disclosure. COVID-19 has thrust an important ESG issue into the spotlight that is often incorporated into company analysis but not as often discussed – workplace safety. Obviously from a human capital point of view, a safe workforce is imperative, whether in the developed world or in emerging and frontier economies. What the pandemic has exposed in the harshest light are the economic consequences of unsafe work.

Until early 2020, we understood essential front-line workers to be primarily doctors, nurses, law enforcement, military, first responders, and the like. In the age of coronavirus, we now have a better understanding that the front line is not necessarily always where we can see it. It is on farms, in meat processing facilities, in the cab of a semi truck, stocking grocery store shelves, driving a city bus, or standing in front of a classroom. Safety in the workplace can be measured from an investor’s point of view in many ways such as counting injuries and fatalities, assessing the mental health of a workforce, measuring exposures to toxic and dangerous materials, and exposing and quantifying workplace violence and harassment.

The human cost translates into economic costs when the safety of workers is in question. As a prime example, we have observed over the last several months the fragility of the supply chains in food systems with the explosion of coronavirus cases in slaughterhouses shutting down capacity to process pork, beef and poultry. Downstream, we saw empty cases in the meat section of the grocery store, and upstream we saw animals having to be destroyed because farmers had to make the financial Hobson’s choice between feeding and caring for animals they could not sell, or putting down the animals and losing their investment that way.

More than 100 years after Upton Sinclair’s “The Jungle” we are still astonished by the unsafe and unsanitary operating conditions of these processing facilities, which are largely kept out of view except for the occasional food-borne illness outbreak, which is never comprehensive enough to actually deprive the market of sufficient food. The coronavirus has demonstrated the fragility of that system as it is set up, where the workplace is not safe, spaced and hygienic enough to prevent pathogenic transmission, and the compensation poor enough that workers tend to live in high-density situations that foster further spread. There was no slack in the system, and the result was a supply shock compounded by weaknesses elsewhere in the food supply chain – Americans experienced rationing (although not government-mandated) for the first time since WWII.

As ESG investors, without even starting a more traditional ethical and environmental discussion of animal cruelty and the environmental impact of farmed meat, we have directly felt the tangible economic consequences of companies failing to provide sufficiently safe workplaces for a critical industry as COVID-19 effectively broke the system. As we head into the last third of 2020 and stumble toward reopening the broader economy, we see companies having to reimagine what a safe workplace looks like industry by industry. Businesses that were already oriented toward a more innovative human capital-first approach to work were more resilient and better able to continue operations or reopen more quickly, obviously rewarding stakeholders including employees, customers, and investors, a lesson that will not be lost on the rest of the market.

AUGUST 2020 CAPITAL MARKET REVIEW

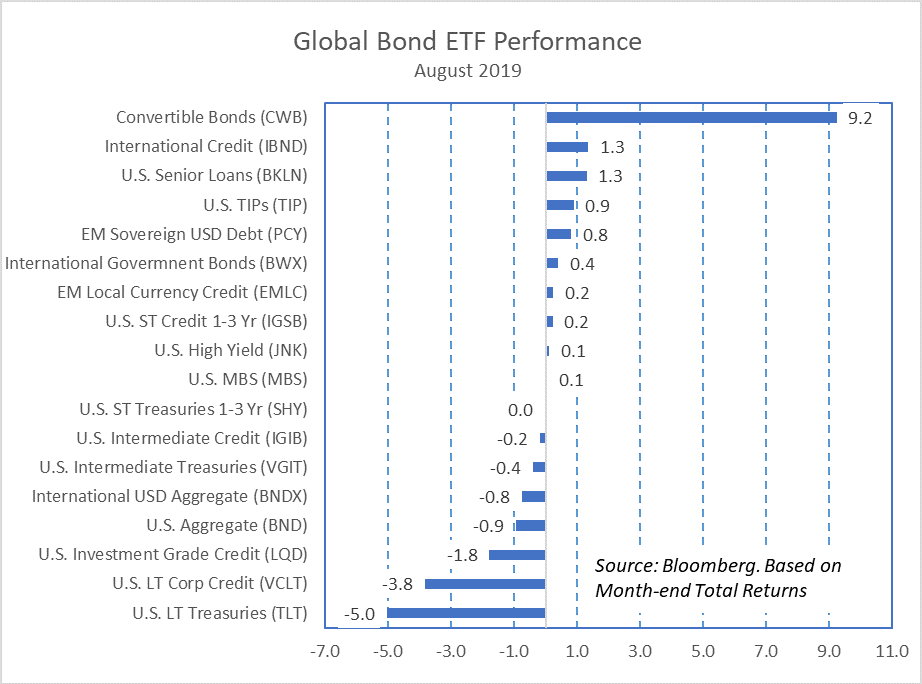

Global equities continued their torrid pace, rallying 6% in US dollar terms. US fixed income markets were mixed, led by sizeable gains in Convertible Bonds, while longer-dated US fixed income sold off. International credit rallied while government bonds declined.

Bond Markets*

US Convertible Bonds rocketed up 9.2% in August leaving the rest of the fixed income coverage universe in its wake. The aggregate US fixed income market disappointed, contracting 0.9%. The long end of the US bond market fared the worst with long-term credit and treasury bonds declining 3.8% and 5% for the month.

The U.S. dollar fell another 1.52% in August marking the third straight month of weakness, according to the Bloomberg Dollar Spot Index.

Equity Markets*

Global stocks were led by US Large Caps sprinting to a 7.0% gain. Japanese equites, measure in US dollar terms nearly matched the US by advancing an impressive 6.8%. Germany was also among the outperformers posting a 6.5% gain in August.

The rest of the world was more tempered, albeit posting respectable gains ranging from Asia ex-Japan’s 5.2% gain to the United Kingdom’s 2.7% advance. The world’s larger markets dominated, and US Mid & Small Caps and Emerging Markets underperformed.

*The returns cited reflect total return performance of exchange traded funds listed in the corresponding bar charts

DISCLOSURES

Conscious Capital Wealth Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

It is important to remember that there are risks inherent in any investment and that there is no assurance that any money manager, fund, asset class, style, index or strategy will provide positive performance over time. Diversification and strategic asset allocation do not guarantee a profit nor protect against a loss in declining markets. All investments are subject to risk, including the loss of principal. The information contained herein is based upon the data available as of the date of this document and is subject to change at any time without notice.

Portfolios that invest in fixed income securities are subject to several general risks, including interest rate risk, credit risk, the risk of issuer default, liquidity risk and market risk. These risks can affect a security’s price and yield to varying degrees, depending upon the nature of the instrument, and may occur from fluctuations in interest rates, a change to an issuer’s individual situation or industry, or events in the financial markets. In general, a bond’s yield is inversely related to its price. Bonds can lose their value as interest rates rise and an investor can lose principal. If sold prior to maturity, fixed income securities are subject to gains/losses based on the level of interest rates, market conditions and the credit quality of the issuer.

Foreign investments are subject to risks not ordinarily associated with domestic investments, such as currency, economic and political risks, and may follow different accounting standards than domestic investments. Investments in emerging or developing markets involve exposure to economic structures that are generally less diverse and mature, and to political systems that can be expected to have less stability than those of more developed countries. These securities may be less liquid and more volatile than investments in U.S. and longer-established non-U.S. markets.

An investment in small/mid-capitalization companies involves greater risk and price volatility than an investment in securities of larger capitalization, more established companies. Such securities may have limited marketability and the firms may have more limited product lines, markets and financial resources than larger, more established companies.

Portfolios that invest in real estate investment trusts (REITs) are subject to many of the risks associated with direct real estate ownership and, as such, may be adversely affected by declines in real estate values and general and local economic conditions.

Portfolios that invest a significant portion of assets in one sector, issuer, geographical area or industry, or in related industries, may involve greater risks, including greater potential for volatility, than more diversified portfolios.

Important Disclosures: Exchange-Traded Funds

Exchange-traded funds (ETFs) are investment vehicles that are legally classified as open-end investment companies or unit investment trusts (UITs) but differ from traditional open-end investment companies or UITs. ETF shares are bought and sold at market price (not net asset value) and are not individually redeemed from the fund. This can result in the fund trading at a premium or discount to its net asset value, which will affect an investor’s value. Shares of certain ETFs have no or limited voting rights. ETFs are subject to risks similar to those of stocks.

ETFs included in portfolios may charge additional fees and expenses in addition to the advisory fee charged for the Selected Portfolio. These additional fees and expenses are disclosed in the respective fund/note prospectus. For complete details, please refer to the prospectus.

For additional information regarding advisory fees, please refer to the Fee Summary and/or Fee Detail pages (if included with this report) and the program sponsor’s/each co-sponsor’s Form ADV Part 2, Wrap Fee Brochure or other disclosure documents, which may be obtained through your advisor.

Certain ETFs have elected to be treated as partnerships for federal, state and local income tax purposes. Accordingly, investors in such ETFs will be taxed as a beneficial owner of an interest in a partnership. Tax information for such ETFs will be reported to investors on an IRS schedule K-1. Investors should consult with their tax advisors in determining the tax consequences of any investment, including the application of state, local or other tax laws and the possible effects of changes in federal or other tax laws.