Click Here to download the article from the Investments & Wealth Monitor

A dynamic movement is under way that is fundamentally changing the way we invest and conduct our financial advisory businesses. We are amid a transformational time that includes regulatory pressures, technological advances, aging distribution and clients, commoditization, big data, new forms of currency, and educated consumers who are becoming more conscious of their investing options. This adds up to a market that is demanding that financial advisors bring more value to their clients.

Advisors who are more conscious about the impact of their work and consider how their decisions affect themselves, their clients, and the world around them will thrive throughout this transition and achieve conscious alpha. If financial advisors integrate this concept of “conscious alpha” into their advisory practices, they will be better positioned to potentially increase investment returns, improve client retention, and bring more passion and purpose to their practices and personal lives.

CONSCIOUS ALPHA

Conscious alpha refers to the increase or alpha that is gained from operating in a conscious way, beyond the benchmark of how a similar group of people are operating. Financial advisors can achieve positive conscious alpha by operating their practices with a more conscious method compared to other financial advisors. The two areas of focus within your practice where you can achieve conscious positive alpha are:

1. How you interact with your clients and the experience you provide for them

2. How you invest your client’s money

CONSCIOUS INVESTING

In this article, I focus on how to increase positive conscious alpha in your advisory practice by concentrating on the way you invest your client’s money— what I call “conscious investing.”

Since you are still reading this article, chances are that you are one of the many who are waking up and beginning to consider how your decisions affect not just you and your clients, but also the world around you. You may be buying more organic food, shopping at green businesses, and supporting a range of worthy causes. You may be paying more attention to the money you spend, but do you know what the rest of it is up to?

The idea of conscious investing might make you think of oddball mutual funds, troubled solar companies, or sacrificing returns. If so, it’s time to catch up on the recent research. Times are changing and so are your clients.

Only when you’re truly and fully conscious of your money—how you earn, spend, and invest it, and how it’s connected to the rest of the world—can you align it with the beliefs and priorities that guide the rest of your and your clients’ lives.

Conscious investing includes both inclusionary and exclusionary forms of investing. In other words, conscious investing considers factors other than traditional quantitative measurements designed for the singular purpose of increasing investment returns. Conscious investing is investing with a higher purpose beyond pro t and uses the identifiable qualities of conscious corporations during the stock and bond analysis to enhance returns.

BECOMING CONSCIOUS

Before we delve any further into conscious investing, let’s step back for a minute and dig into the depth and purpose of this subject. Could some of the teachings from ancient wisdom and the shamans unravel some of the mystery of conscious alpha?

What does it mean to be “conscious”? A dictionary would say something like “the state of being awake and able to understand what is happening around you.” Being truly awake and aware is the first step, and it’s a big one. When we are fully conscious we inhabit and come to terms with the present, the moment, the all important now. Great spiritual and religious traditions agree that this is the only true reality. It may be challenging, but it’s the only place where we can experience our authentic selves and participate in the world with purpose.

Indeed, something happens when we embrace the present. By embracing the present, we realize that it’s not about us, it’s about everything. Everything in the universe is connected, undifferentiated, one. I have been blessed to have this infinite view, but many people have only glimpsed this reality. Whether they get there intentionally through meditation, or by chance in a moment of inspiration or crisis, waking up and becoming present can be unsettling—so the conscious mind reasons it away as something crazy or ignores or discounts it altogether.

In some respects, your money works much the same way. Sure, it’s just some thing humans have made up: It’s not part of the universe’s life force, and it stopped being backed by gold in the early seventies. But here on earth it’s a powerful force nonetheless. It’s as much a part of you as anything else in this material world. And most of us are barely aware of how it connects us to everyone and everything else.

FINANCIAL ENLIGHTENMENT

The first big step in conscious investing is simply to be aware of where we’re put ting our money. That may sound obvious, but many of us don’t really know. Most clients invest based on recommendations from friends or family, or traditional advisor driven metrics. Either way, our money gets lumped in with billions of other dollars, then scattered throughout the global economy.

Fully appreciating how our money touches everything, everywhere, is a lot like the more familiar kind of enlightenment. Once we become aware, everything looks and feels a little different. Why is my money trashing the planet’s environment, polluting our food, abusing workers, and altering our climate? Why is my money subsidizing corporations that rule by fear and greed, where top executives take home 400 to 2,000+ times the pay of average employees? On the ip side, what is my money doing to support sustainable practices, human development, my longterm financial returns, and all the other things I care about?

The final realization is what a big deal this is. Choosing organic, fair-trade coffee this morning was a conscious investment of three or four dollars. How much bigger is your retirement fund and the assets you manage for your clients?

DOING WELL BY DOING GOOD

If I’m preaching to the choir, then you get it. What can you do? Won’t invest ing your client’s money in do good, low performing companies and mutual funds cost a lot more than that cup of coffee? But with everything else you have to juggle in your day today responsibilities, how would you success fully integrate this into your practice? And if you did, could you potentially increase investment returns, increase client growth and retention, and bring more passion and purpose into your practice and personal life?

The good news is that much has changed since the early days of ethical investing. Back then you were lucky just to find a socially responsible fund

or advisor. Handing over your money felt a bit like filling the collection plate: giving up some financial returns for the sake of feeling good about where your money goes. These days the “good guys and gals” in both investment and business are much more numerous and prominent; in fact, many also are outperforming their peers and achieving conscious investing alpha.

HOW WE GOT HERE

It’s nothing new. Centuries ago, a tiny minority of Quakers in England and America created business empires based on “honesty, fair dealing, and quality products” (Moriuchi 2012). Their success, combined with a deep commitment to doing good in the world, allowed them to have an impact on society—on issues such as slavery, poverty, and mental health—that was enormous considering their numbers.

This type of investing began picking up speed in the 1970s and became a way for individual investors to avoid or include a bias toward specific stocks based on categories or screening. The most popular form of exclusionary or negative screening at that time was sin stocks: tobacco, alcohol, adult entertainment, and other such depravities. Most decisions to exclude stocks were based on morals and personal values and investment return considerations were secondary.

Conventional wisdom said that by excluding stocks based on qualitative data as a primary factor, two bad things would happen. First, you would limit your investment universe and consequently decrease diversification, which would break down a core tenet of modern portfolio theory (MPT). Second, you would eliminate some good performing stocks that otherwise would have been part of your portfolio, so your returns would decrease. The combination of straying from the structure of MPT and excluding stocks primarily because of feelings rather than an empirical rationale or quantitative process was a noble gesture, but it was almost certain to carry a cost.

Today, the average consumer and advisor still maintain this old belief system. Each might respond with, “I know I will be making less money, but at least I will feel good about not giving my money to things I don’t believe in.” But that old paradigm is changing. You no longer need to feel like you are putting money into the collection plate. In fact, the opposite may be true. Embracing the magic of conscious alpha as way to address stock selection may help you increase returns and give you a powerful competitive edge.

Several drivers, including increasing natural resource scarcity, regulatory pressures, shareholder expectations, and board accountability, are contributing to a remarkable correlation of economic outperformance for conscious companies. But could something larger be behind this trend?

A growing number of today’s best purpose driven companies pay their employees more, treat their suppliers well, deliver topnotch customer service, make consistent and substantial investments in their communities and the environment, and in some cases even pay more taxes. These companies have a soul, a purpose beyond profits, resulting in a triple bottom line that recognizes three categories of stakeholders: people, planet, and profits. A 15-year study of some of these rms demonstrated that they outperformed their peers by as much as 14 to 1 (Sisodia et al. 2014).

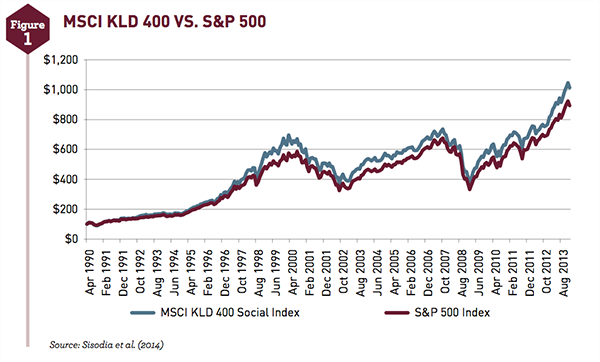

In addition, the benchmark performance of the MSCI KLD 400 Social Index, which includes rms meeting high environmental, social, and governance (ESG) standards, has outperformed the S&P 500 on an annualized basis by 45 basis points since its inception (10.14 percent, compared to 9.69 percent for the S&P 500; July 1990–December 2014), as shown in figure 1.1

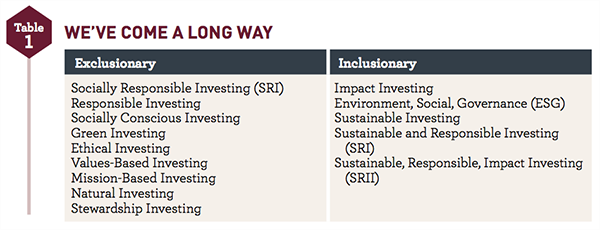

Investing to do well in addition to doing good has been called by a lot of different names (see table 1). With all these different labels, we risk confusing the market and creating our own little dogmas, and it can be confusing to the most seasoned professional. However, if we break it down into two different categories— exclusionary versus inclusionary—we can make it quite simple:

Exclusionary: Exclusionary approaches exclude harmful factors or themes.

Inclusionary: Inclusionary approaches include ESG factors and expand the investment focus to integrate multiple stakeholders, not just shareholders.

Inclusionary approaches include risk and reward metrics as part of the overall equation. These accretive qualitative metrics are often elusive data points that are overlooked by conventional stock analysis and overall portfolio construction. This inclusive approach creates the promise of true positive conscious investing alpha.

When the fear of sacrificing returns is replaced with the promise of out-performing returns, we will observe a zeitgeist. The question is not if, it is when—and will you be ready? Someday this entire conversation about names will disappear as these inclusionary strategies merge with traditional stock analysis.

GROWING AND RETAINING YOUR CLIENTS

JOIN THE MOVEMENT

Conscious investing is becoming a movement. Just as the organic and fair trade movements have gone main stream, more people are becoming concerned about the impact of their money: 74 percent of investors say they would be more likely to work with an advisor who could offer investment strategies that result in both competitive returns and a positive impact on society.

In March 2014, I spoke to industry leaders at a Morningstar conference for the Retirement Income Industry Association. Because this topic carries so much emotion, I lightened things up a bit with a mindfulness meditation to demonstrate that we are all in this together (and assured them they would not have to trade the Mercedes for a Prius to become part of this movement). The point I was making was whether you choose to believe in this style of investing or not, the market demand is coming.

Since then, the Global Sustainable Investment Alliance (GSIA) has reported that at the start of 2016, global sustainable investments reached $22.89 trillion. As of 2016, there was $8.7 trillion in professionally managed sustainable portfolios, representing a 33percent growth over two years.2 In 2017, 73 percent of Fortune 500 companies are reporting on sustainability.

Relating to this market, however, will take more than brushing up on some green mutual funds. Investment advisors who don’t incorporate conscious invest ing in their practices might miss out on today’s largest generational trend in money management. State Street asked retail investors how they learned about ESG investing, only about a third (38 percent) said from their financial advisors. Conversely, the vast majority (83 percent) answered that they learned about ESG investing from their own research or family and friends. In addition, 49 percent of nonESG investors said they believed talking to their advisor about ESG investing would be useful.3

In one study among high net worth clients, nearly one half of all respondents said that they would consider sustainable investing, but fewer than half said they have ever been approached by their advisors about this topic.4

Steven Schueth, the president of First Affirmative Financial Network and the producer of the SRI Conference, put it best when he described the state of the market:

One can think about the SRI (sustainable, responsible, impact) investment industry using the metaphor of an hourglass. One glass bulb reflects today’s reality that there are many excellent, proven investment products and strategies. The other bulb is an illustration of the fact that there is a large and growing number of investors who are interested in a more responsible approach to investing. The narrow point—the bottleneck—in the middle is the community of licensed investment professionals. There is a huge potential market for those who are willing to step out of their comfort zone and work with investors who are looking for something more from their investment portfolios other than simply making money. There are huge opportunities for advisors who are willing to learn about and deliver what socially conscious clients need from them: ways to make money and have a positive impact on our world, at the same time.

For the advisor who is authentically passionate about using the power of money to help make their clients’ world a better place, there has never been a better time to grow your practice.

Being an investment advisor can be stressful. Conscious investing will make you feel principled—about your impact on the world as an individual, about strengthening a growing movement, and about bringing your practice in line with the purpose of your life. It’s good for the world and good for your soul.

Working toward a higher purpose will help you attract and retain more of the right clients, coworkers, and revenue.

THE SURGE OF DEMAND AND ITS SOURCE

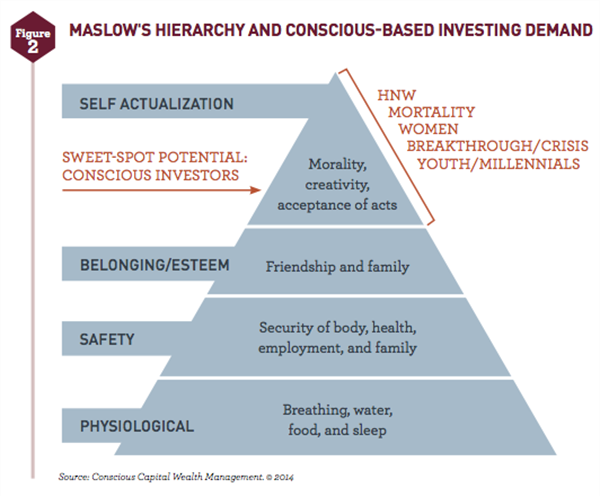

If you want to know where this market is coming from, consider this conscious based investing diagram (see figure 2).

Maslow’s theory about the hierarchy of needs holds that the most basic needs must be met before an individual will be motivated to focus upon secondary or higher level needs. For the purposes of this article, we can equate self actualization with a higher level of consciousness or awakening, which leads to the propensity to invest in a more conscious manner.

People at the top of the triangle care about how we are all connected and they demand meaning and purpose in their lives, which includes how they spend, how they invest, and where they work. The people generally fall into the follow ing categories:

HNW: High net worth clients are not consumed with paying the bills, so these investors have the natural tendency to be able to care more about their investments having a purpose beyond profit alone.

Mortality: As we get closer to the inevitability of death, we move closer to meaning and purpose; when large percentages of the population are aging (as is happening in many countries), a cultural shift takes place with an intense momentum.

Women: In my opinion, most women seem to be more conscious than most men. Not to mention the fact that “[o]n a global level, women are the biggest emerging market in the history of the planet—more than twice the size of India and China combined” (Bennett and Ellison 2010).

Breakthrough/crisis: When people go through a crisis or transition in life, they often begin to question more things and wake up to the idea that we are not separate from each other and the world itself. Consequently, they tend to care more about what their money does after it leaves their sight.

Youth/millennials: This cohort is demanding more meaning in their work and purpose in their investing.

We are experiencing a great transfer of wealth and the children who will be receiving these assets are demanding conscious investing. According to Investment News data, 66 percent of children re their parents’ financial advisors after they receive an inheritance. Incorporating conscious investing is one way to help attract and retain your client’s heirs.

The younger generation is demanding more purpose and meaning in their world and does not separate their work and investments from their values and beliefs. According to a U.S. Trust “Insights on Wealth and Worth” study (2017), wealthy millennials are almost twice as likely as their grandparents to regard their investments as a way to express social, political, or environ mental values; furthermore, nearly three quarters of millennials believe that it is possible to realize market rate returns by investing in companies based on their social or environmental impact. If advisors are not prepared to have these discussions with their clients, their clients will and someone who is.

ONE SMALL STEP

Moving from intention to action is as challenging in financial matters as in spiritual ones. Likewise, the path is made up of small, practical steps: Educate yourself, start small, and have fun. Being the subject matter expert is fundamental to the success of your business, and taking on a whole new area of expertise is not something most advisors have the luxury of doing. Don’t attempt to learn it all in one bite. Choose a lane: Will you be the asset manager? The fossil-free master? Figure out what you are going to attack and leave the rest to partners.

EDUCATE YOURSELF

Go to conferences and hang out with likeminded people. Steven Schueth, mentioned above, is a pioneer in this space, and he recommends attending the annual SRI Conference as a way of being exposed to a full spectrum of opportunities. The SRI Conference is one of the first and largest events to deal with these issues. Smaller advisor driven events also are becoming more common. Jeff Gitterman, a leader in conscious investing, hosts the Sustainable Investment Conference for Financial Advisors. You can also watch for leaders such as Ron Cordes speaking about and doing wonderful work in impact investing.

Read the powerful new books that dis sect and explain this global movement. They include The Rise of the Meaningful Economy: A Mega trend Where Meaning Is a New Currency (Drewell and Larsson 2017); The Values-Driven Organization: Unleashing Human Potential for Performance and Pro t (Barrett 2017); and Firms of Endearment: How World-Class Companies Pro t from Passion and Purpose (Sisodia et al. 2007), among many others.

All these strategies will create a solid foundation and lead you to many more resources and surprises.

START SMALL

To avoid feeling overwhelmed, start with just a small slice of your client’s portfolio. See how the investments perform—and how they make you and your clients feel. Then increase your conscious investing as you get more comfortable. Keep in mind that there’s no right way that works for everyone. Remember that you don’t have to have all the answers; partner with firms that can help you. Investigate firms such as:

- Savos, which provides entry for clients at $25,000 minimums, with fully screened and customized separately managed accounts.

- Exciting new startup asset managers such as Work Capital.

- Arabesque, which is leveraging big data self-learning quant models to provide superior decision-making (and transparency).

- GlobalX, which has an exchange traded fund model called KRMA that allows low-cost access.

- MSCI, which offers a wealth of knowledge and resources.

- Learn about United Nations’ sustainable development goals that are driving global awareness and will act as a catalyst to bring capital into motion and purpose.

HAVE FUN

Leveraging the magic of conscious alpha to change the way you invest your clients’ money is only half the story. The second half of the magic of conscious alpha stems from the client experience, providing a more intimate holistic process that embraces the whole person not just the left-brained analytical part of the business. The key is just beginning and having fun again. If you are not passionate about your day-to-day activities, your clients will not be either.

In some parts of the world, a shaman will ask a person who has come seeking advice, “When did you stop dancing?” Ask yourself, when did you stop having fun in your practice? Start dancing again and leverage the power of conscious alpha to help make your clients’ world a better place.

Lawrence Ford, AIF®, is founder and chief executive officer of Conscious Capital Wealth Management (formerly Ford Financial Group). He was dubbed the “Shaman of Wall Street” by the Washington Post. Contact him at lford@consciouscapitalwm.com.

ENDNOTES

- See https://www.msci.com/msci-kld-400- social-index.

- See http://www.gsi-alliance.org/.

- See http://www.statestreet.com/content/

- dam/statestreet/documents/Articles/

- The_Investing_Enlightenment.pdf.

- See endnote 3.

REFERENCES

Barrett, Richard. 2017. The Values-Driven Organization: Unleashing Human Potential for Performance and Pro t (2nd ed.). New York: Routledge.

Bennett, Jessica, and Jesse Ellison. 2010. Women Will Rule the World. Newsweek (July 5). http://www.newsweek.com/ women-will-rule-world-74603.

Drewell, Mark, and Björn Larsson. 2017. The Rise of the Meaningful Economy: A Megatrend Where Meaning Is a New Currency. Stockholm, Sweden/London, UK: CreateSpace Independent Publishing Platform.

Moriuchi, Chiyo. 2012. Doing good and Doing Well. Friends Journal (September 15). http://www.friendsjournal.org/doing-good- and-doing-well

Sisodia, Rajendra, Jagdish N. Sheth, and David Wolfe. 2014. Firms of Endearment: How World-Class Companies Pro t for Passion and Purpose (2nd ed.). Upper Saddle River, NJ: Pearson Education.

Sisodia, Rajendra, David Wolfe, and Jagdish N. Sheth. 2007. Firms of Endearment: How World-Class Companies Pro t from Passion and Purpose. Upper Saddle River, NJ: Wharton School Publishing.

US SIF Foundation. 2016. 2016 Trends Report. http://www.ussif.org/ les/Trends/US%20 SIF%202016%20Trends%20Overview.pdf.

U.S. Trust. 2017. U.S. Trust Insights on Wealth and Worth, Findings Overview. http://www. ustrust.com/publish/content/application/ pdf/gWMOL/USTp_WW_FindingsOverview_ Broch_Final.pdf.

LIVE WHOLETM

Advisory Services offered through Conscious Capital Wealth Management, LLC (CCWM). Lawrence Ford is a Registered Representative of J.W. Cole Financial, Inc. (JWC) Member FINRA/ SIPC. JWC and CCWM are unaffiliated. All expressions of opinion in this commentary reflect the opinions of the author and not necessarily those of JWC or CCWM. This commentary does not constitute an offer to sell or a solicitation to buy any security. Neither JWC nor CCWM offers tax and/or legal advice and it is strongly recommended that you consult with your legal or tax professional for guidance on your particular situation.