There are multiple layers of the global economy. Today, we’ll set aside the critical components of the physical goods economy, as well as the service economy, in order to focus on the blending of the digital economy with the financial economy. Together, those create a flywheel of unimaginable size and speed. But first, a bit of a primer:

In the book Sapiens, author Yuval Noah Harari identifies that the most powerful entities on the planet are human ideas. At one level, it seems so simple, but when we remember back to our ancient ancestors, many natural beings were much more powerful than we were. Lions and bears, never mind mammoths and saber-tooth tigers, presented very real threat to human life and limb. Today, however, corporations and banks, served by the money and laws that support them, have substantially more power than beasts.

Each of those last four entities are, on one hand, mere figments of our imagination; just stories that we’ve made up, a sophisticated evolution of pictograms inside of a cave. As my colleague Doug Wilde said on one of our internal investment calls, “there isn’t even enough ink on the planet” to print all the money the Fed created in 2020 to stave off an economic catastrophe. His point is well-taken; at one level, the only thing that happened during these phases of Quantitative Easing was the addition of some numbers to a spreadsheet somewhere, and the whole economy — along with human life on earth — changed.

It’s pretty wild if you think about it. And even if you don’t.

DIGITAL ECONOMY

During the pandemic we revised our understanding of the role that the digital world plays in everyone lives. Even grumpy old mountain men begrudgingly carry an iPhone and pay the monthly fees to stay connected to their families, friends, and to the ubiquitous online spaces where old men grump at each other for hours on end. At the other end of the spectrum, teens from around the world barely disconnect from the extraordinary digital worlds, befriending people they will likely never meet in a physical space.

FINANCIAL ECONOMY

Although ubiquitous companies like Goldman Sachs and Charles Schwab were built on top of paper and slide-rules by the actual “men in green eye-shades,” those times are well behind us. Today, international transactions clear almost immediately, and more money flows around our planet than was even conceivable just 30 years ago.

All of our personal bank accounts, investment trading, and financial planning (not to our digital tokens) live “in the cloud,” accessible to us (and, if we’re not careful, to others, as well) from any device and any location at any time. I recently read that JP Morgan Chase is doing away with offering safety deposit boxes; another sign that finance is fully digitized.

This all sits on top of the internet, which is now partially run by quasi-autonomous, renewable-energy-powered data centers on and below earth, transmitted through the upper reaches of our atmosphere by satellites, and moved through heavy cables at depths of the ocean that few humans have ever travelled.

The internet is not only poised to out-last your life, but if you add in a small dose of artificial intelligence, it has the potential to out-last all human life.

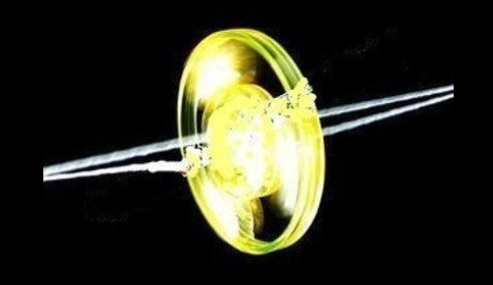

When I add this all together, I see a massive virtual flywheel made of energy and light, spinning extraordinarily fast in the collective psyche of human imagination. Without stopping to try and calculate its hypothetical size, I imagine it to be thousands of miles in diameter, spinning at speeds that create gravitation pull. Don’t believe me? Just look at the faces of the humans staring at screens in ever corner of our planet.

There are those who resist the ideas and implications that follow, and yearn for simpler times. But if you think we’re going to simply turn it off, burn it down, or throw a wrench into the gears, you’ve deceived yourself beyond any credulity.

I don’t believe this flywheel is inherently bad or dangerous; it’s just another idea we’ve inadvertently created, one with incomprehensible power, and, potentially, autonomous controls.

As conscious beings feeling into the details of how to responsibly ensure that this global-scale entity doesn’t conspire to shake us off the planet like a nasty case of the flu, what are we to do?

First, it’s imperative that have a firm understanding of what and who we actually are; the creators of this flywheel. Next, we’ve got to learn how to direct the flow of this energy towards the outcomes we want. Rather than trying to slow down the flywheel, or throw ourselves upon its gears, I think the evolutionary move now is to shift the orientation of the axis around which it spins. We’ll have to do that with — you guessed it — ideas; new ones, specifically, that re-orient the flow of all of this energy.

Today, we are using simple frameworks to re-orient how money is invested. ESG (environment, social good, and governance) investing has certainly nudged this axis a bit; beginning the practice of integrating these factors (previously called “externalities” onto global balance sheets). We will need new and more regulations, ongoing innovation (ahem, blockchain), and. most importantly, the collective will to shift our behavior.

All that is possible. All it takes is an idea. Maybe we can start by sketching it out on the inside of a cave, out in the woods…. Join me on a walk some day soon, and I’ll show you where I’ve started.